I am not talking about the Big Bang or the Inflationary Theory of Cosmology but the prosaic, far more mundane, almost boring inflation that Economists talk about.

In 2018 the RBI, in its bi-monthly meeting, decided that inflation was higher than it should be and they should increase the interest rate to rein it in. This meant prices are rising faster than desirable. However, nearly everything I could buy was cheaper than at any time in the previous few years. This was driven largely by the boom in digital payments, nearly all of which involved some form of cashback, discount or offer that made prices really low. This divergence between my personal experience and the view that central bank carried made me start looking at prices more closely. I began looking at personal household expenses to see if I could correlate my experiences to the macro data that was reported periodically. To my disappointment I found that I could not discern any direct correlation at all. Obviously, inflation was a very well established metric and calculated by experts at every country’s central banker/government etc. But then why couldn’t I relate it to my personal experiences? Perhaps it was just that my methods were too informal. Or perhaps it was to do with the averaging effect over a billion++ people.

Feb 2016: CPI was 123.8

Feb 2019: It was 138.6

an inflation of 11.9% relative to an year ago

FEB 2020: 147.7 – 6.5% over the year

Govt of India statistics

When seen on the macro scale of my life, inflation was so clearly obvious that it did not need math. Salaries of engineers fresh out of college had moved from a few thousand Rupees when I started working to the few tens of thousand – a 10x increase for what was (arguably) the exact same type of work. School fees that my dad paid for my schooling was approximately a thousand times lower than that I paid for my daughter’s schooling. Key groceries like sugar were 20-30 times higher now than in my childhood. But why couldn’t I observe this factor playing a role in my daily life? Too small a change on timescales of months or even an year? And yet, there seemed to be a very clear expectation that changing interest rates by 0.5% will change people’s behaviour.

Inflation of 5% – 8% were the norm in the last decade. That meant nearly everything should be twice as expensive as ten years ago. Rentals in my area were very similar, perhaps 15% more than they were 10 years ago. Staples were more expensive but I felt that they were not 2x – though the lack of personal records meant that I could not really tell. Milk did seem to be 2x from memory while domestic help seemed to be at about 4x.

Going further back, I recollect a company, who we used to supply our products to, which had this unusual practice of linking compensation directly to inflation. Each employee would get a performance rating at the end of every year. This would translate into a salary raise as rating+a base (which was equal to the country’s inflation rate). This, when I first heard of it, was sort of an eye opener. I tried to apply this in my organization and it fell flat – a 5-6% base raise (which was the inflation then) for a software engineer at that time would have elicited either convulsions of laughter or a quick departure to a saner company. But my interest was piqued.

Then there were the doomsday predictors – the insurance salesmen – who would whip out sheets which showed that nothing you saved could help once you stopped earning, as everything would be super expensive by then. Medical expenses for the merest consultation would cost more than a year’s income after retirement, children’s education would take the arm and leg it does now and one will need to trade in a kidney as well. The source of these enormous projected costs? Inflation.

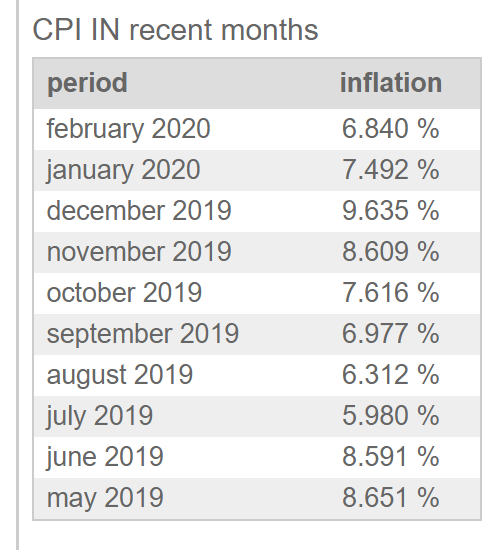

Amidst all this were economists who would, in more recent times towards the end of 2019, be confidently predicting that inflation was falling and people will spend more because interest rates were reducing and yet my housing loan EMI stayed where it was, with such a minor change in the tenure that I would need a microscope to see its movement.

So what really is inflation that is relevant to me and, more importantly, what role does it play in my life? That’s the question that started this quest.